Embracing the Routine

The Importance of Having a Daily Routine in Retirement

Retirement is often seen as a time to relax, unwind, and enjoy the fruits of your labor. While it's true that retirement allows for more freedom and flexibility in how you spend your time, having a daily routine can actually be incredibly beneficial for retirees. In this blog post, we will explore the importance of having a daily routine in retirement and how it can enhance your overall well-being and quality of life.

One of the key benefits of having a daily routine in retirement is the sense of structure and purpose it provides. After years of working and following a set schedule, suddenly having all the free time in the world can be overwhelming for some retirees. A daily routine helps to provide a sense of normalcy and consistency to your days, giving you something to look forward to each morning. Whether it's waking up at the same time every day, enjoying a leisurely breakfast, or setting aside time for hobbies or exercise, having a routine can help create a sense of balance and stability in retirement.

In addition to providing structure, having a daily routine in retirement can also help improve your mental and physical health. Engaging in regular activities such as exercising, socializing with friends, or pursuing hobbies can have positive effects on both your physical well-being and cognitive function. A routine that includes activities that stimulate the mind and body can help reduce feelings of isolation or loneliness that some retirees may experience after leaving the workforce. By staying active and engaged in meaningful activities, you can maintain your overall health and vitality during retirement.

Having a daily routine can also help retirees stay organized and manage their time effectively. With more free time on their hands, retirees may find themselves feeling overwhelmed by all the things they want to do. By establishing a daily schedule that includes specific tasks or goals to accomplish each day, retirees can prioritize their activities and avoid feeling scattered or unproductive. This sense of accomplishment from completing tasks on a regular basis can boost self-esteem and confidence in retirement.

A daily routine in retirement is a great opportunity for personal growth and exploration. Retirement is an ideal time to try new things, learn new skills, or pursue passions that may have been put on hold during your working years. By incorporating learning opportunities or creative pursuits into your daily routine, you can continue to grow as an individual and discover new interests that bring joy and fulfillment to your life. Embracing change and embracing new experiences through a structured routine can lead to personal growth and self-discovery during retirement.

In conclusion, establishing a daily routine in retirement is essential for maintaining structure, promoting health and well-being, managing time effectively, and fostering personal growth. While retirement offers plenty of opportunities for relaxation and leisurely pursuits, incorporating a routine into your daily life can provide numerous benefits that contribute to overall happiness and fulfillment during this stage of life. So embrace the routine, find what works best for you, and enjoy all that retirement has to offer!

Recent Blog Posts:

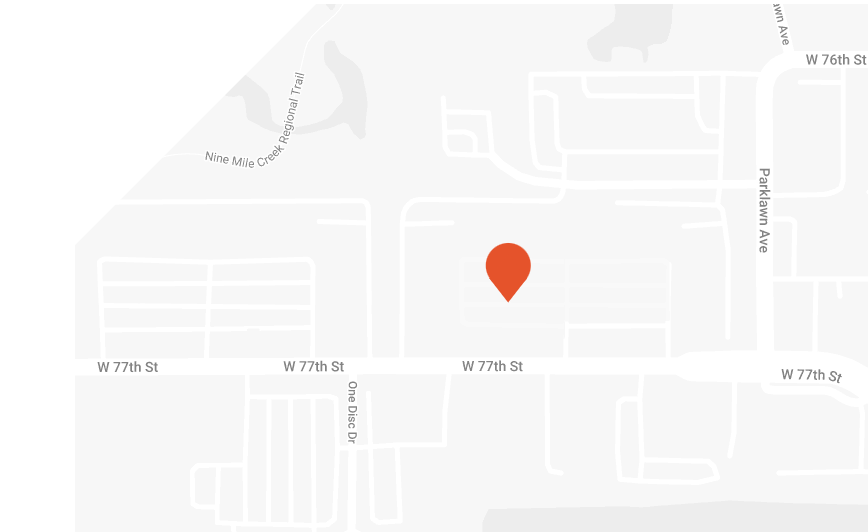

Get in touch or visit our office.

Sign up for our newsletter and get instant access to our complimentary retirement guide.

Newsletter

We will get back to you as soon as possible.

Please try again later.

© 2023 CFG RETIREMENT

Investment Advisory Services offered through Assured Retirement Financial Group, Inc DBA CFG Retirement. CFG Retirement is a Registered Investment Advisory firm with the SEC.

Insurance services offered through Assured Retirement Group, Inc DBA CFG Retirement. Assured Retirement Financial Group, Inc. and Assured Retirement Group, Inc. are affiliated companies.

Provided content is for overview and informational purposes only and is not intended and should not be relied upon as individualized tax, legal, fiduciary, or investment advice. By contacting us, downloading booklets, or attending events, you may be offered a meeting to discuss how our insurance and other services can meet your retirement needs. The presenters of this information are not associated with, or endorsed by, the Social Security Administration or any other government agency.